Introduction

These days, many taxpayers are getting GST return discrepancy notices in the form of GST ASMT-10. It has been four years now since GST came into force. The department is now scrutinizing GST returns filed during the last four years, due to which the taxpayers are receiving more ASMT-10 notices. Through this article, we seek to summarize all the relevant provisions and facts about GST ASMT-10.

What is GST ASMT-10

As per

Section 61, a GST Officer is required to check the GST returns based on certain risk parameters. This assessment seeks to ensure the correctness of the return. In case the assessment indicates a high risk of default or any indication of fraud, a scrutiny notice in the form of GST ASMT-10 is issued. However, there is no personal hearing in this assessment.

GST ASMT-10 is merely a notice where discrepancies are found and intimated to the taxpayers.

The Proper Officer may quantify the amount of tax, interest or any other amount payable by the taxpayer in the ASMT-10 itself.

In essence, Form GST ASMT-10 is the notice issued under

Section 61 of the CGST Act, 2017, read with

Rule 99 for intimating discrepancies in the GST returns filed by the taxpayer and seeking an explanation for same. The tax officer can send the notice to the taxpayer via SMS or Email.

The taxpayer is required to file a reply via GST ASMT-11 within

30 days of its issuance. He may request for extension of not more than

15 days.

ASMT-10 mainly contains the following details:

- Basic Details like GSTIN, name, address and Tax period

- Details of discrepancies observed

- Details of the Tax officer issuing notice like name, signature and designation

Some of the most common discrepancies against which scrutiny notice can be issued are as follows:

- Difference in Tax Liability reported in GSTR-1 and GSTR-3B

- Difference in ITC claimed in GSTR-3B and GSTR-2B/GSTR-2A

- Difference in Tax Liability as per E-Way Bill and GSTR-3B

- High deviation in Tax deposited during two or more periods

How to view Scrutiny Notice on Portal

GST Portal >> Services >> User Services >> View Additional Notices and Orders

How to file a reply to ASMT-10

As per Section 61 of the CGST Act, the taxpayer is required to file a reply to ASMT-10 within 30 days in the form of ASMT-11.

Two scenarios may arise in the given situation.

- The taxpayer may accept the presence of discrepancies. In such a case, the taxpayer is required to pay the tax, interest or any other amount as specified in ASMT-10 first via DRC-03 and then inform the Tax Officer via ASMT-11. He will pay via any of the following options:

• Pay Tax in Form DRC

• Furnish invoice/debit note/amended invoice/amended debit note in GSTR1

• Pays tax while filing GSTR-3B

- The taxpayer may disagree with the discrepancies noted. In such a case, he may provide explanation and workings to the Proper Officer via ASMT-11. For example, suppose a taxpayer receives notice for the deviation between liability as per GSTR1 and GSTR3B. In that case, the taxpayer may pinpoint the invoices or any findings causing such deviations and furnish his workings and explanation.

How to file a reply

Select the 'replies' tab on the case details page

- Click on 'Notice' to add a reply

- Enter reply and payment details

- Click on 'ADD' for more details

- Choose a file to upload along with the reply

- Check the verification checkbox and choose authorized signatory

- Check details using the 'Preview' option and then click on 'File'

- Reply can be filed using EVC or DSC

A success message will be generated on filing reply. The Replies tab will get updated to show "Reply Furnished, pending with Tax Officer."

NOTE: Even though the online reply filing procedure is simple, it is advised to submit all the documents along with reply in GST ASMT-11 with the proper officer manually also to be on safer and explain the case. The reason being that the taxpayer can be convincing regarding his arguments while explaining the relevant facts and circumstances.

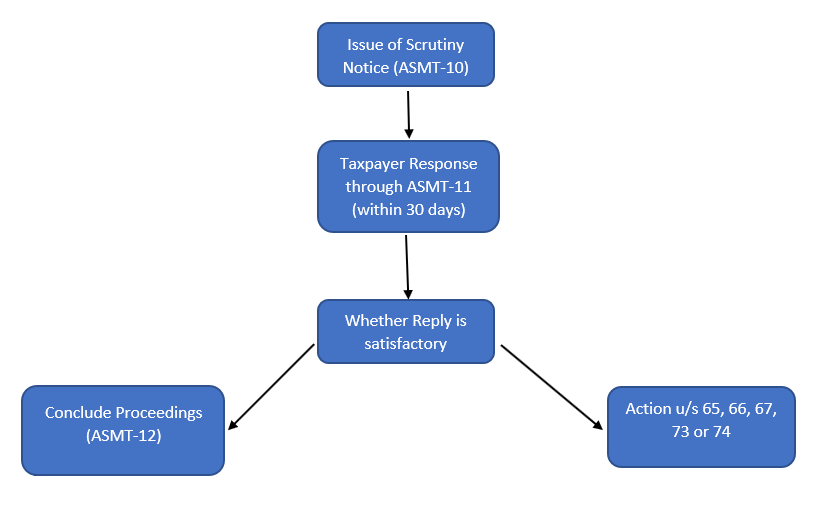

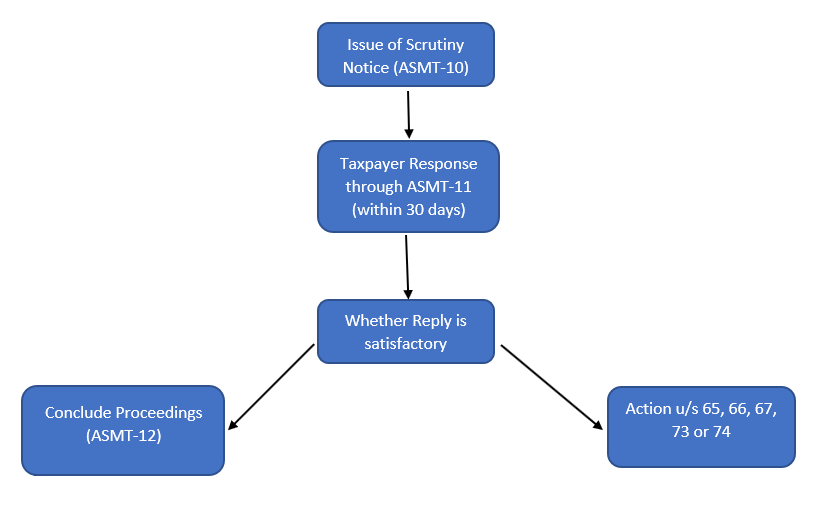

Procedure Post Reply

After submitting a reply, if the Proper Officer is satisfied with the response, he'll drop the proceeding by issuing an order under GST ASMT-12, intimating the same to the taxpayer.

But in case the reply is not found satisfactory by the proper officer, he may take appropriate action under

Section 65, 66, or 67 and proceed to take action under section 73 or 74.

Section 65: Audit by tax authorities

Section 66: Special Audit

Section 67: Inspection, search or seizure

Section 73: Determination of tax not paid or short paid or erroneously refunded or input tax credit wrongly availed or utilized for any reason other than fraud or any willful misstatement or suppression of facts.

Section 74: Determination of tax not paid or short paid or erroneously refunded or input tax credit wrongly availed or utilized for any reason of fraud or any willful misstatement or suppression of facts.

Audits under sections 65, 66 and inspection/seizure under section 67 may be conducted in case the Proper Officer is dissatisfied. Based on the findings, action can be initiated under section 73 (non-fraudulent cases) or Section 74 (fraudulent cases) of the CGST/SGST Act.

There is no timeline for the issue of GST ASMT-12. The proceedings get concluded with the receipt of GST ASMT-12.

The above discussion can be summarized as follows:

Conclusion

In recent times, a lot of taxpayers are getting scrutiny notices and the taxpayers are ignoring the same. It is advised not to ignore the ASMT 10 notices at all. It can cost taxpayers heavily in the form of time, efforts and tax liabilities if not dealt within a time bound manner.

Authored by

CA Rahul Pareva, assisted by

Vrinda Sharma and

Ashish Sharma.

For any queries and suggestions contact at

info@manishanilgupta.com

0 Comment