Businesses often extend multiple types of benefits and perquisites, such as travel packages, gift cards or vouchers, etc., to their distributors, channel partners, agents, or dealers to incentivise and motivate them to promote further growth of the business. In order to regulate the taxability of such benefits or perquisites, the Government introduced Section 194R in the Finance Act, 2022. Section 194R assigns an obligation on the person responsible for providing any perquisite or benefit to a resident to deduct tax at source @10%.

Also, CBDT rolled out a circular detailing certain guidelines on section 194R to remove difficulties in the effective implementation of the section. In the below article, we will, one by one, comprehend the provisions of section 194R and all the guidelines related to the same.

Section 194R: Deduction of Tax on Benefit or Perquisite in respect of Business or Profession

Let us first look at what section 194R says about TDS on benefits or perquisites in respect of business or profession. So, as per section 194R of the

Income Tax Act, any person responsible for providing to a resident, any perquisite or benefit, arising from business or the exercise of a profession, by such resident, shall ensure that tax has been deducted on such benefit/perquisite at ten per cent of the aggregate value of such benefit/perquisite before providing the same to such resident.

In the next paragraph, the section states that in the following two situations, the person responsible for providing the benefit or perquisite shall, before releasing such benefit, ensure that the tax needed to be deducted has been paid on such benefit/perquisite:

a) where the benefit/perquisite is wholly in kind or

b) where the benefit/perquisite is partly in kind and partly in cash, but such part in cash is not adequate to fulfil the liability of TDS in respect of the whole of such benefit or perquisite.

The section further provides that the provisions of this section will not be applicable if the aggregate value of the benefit/perquisite provided to a resident during the financial year does not exceed twenty thousand rupees.

Also, this section would not apply to an individual or an HUF whose total sales are up to one crore rupees in case of a business or gross receipts are up to fifty lakh rupees in case of a profession during the financial year immediately preceding the financial year in which such benefit/perquisite is provided by such person.

Having read the above provisions, let us look at certain aspects of the section that require special consideration:

1) The primary checkpoint before applying section 194R is that the benefit/perquisite is provided to a resident, and it arises from business or exercise of the profession by the said resident. Let us see a few examples below to have a better insight into this clause:

a) Mr. A runs a trading business in the FMCG sector. He provides multiple incentives to its agents to achieve the sale targets. During FY 2022-23, Mr. A offers free tickets for an event to Mr. X, his resident agent. Will this perquisite come under the purview of section 194R?

Yes, the benefit, free tickets for an event in this case, provided by Mr. A to Mr. X, would come under the purview of section 194R as Mr. X is a resident person, and such benefit has been provided on account of business or exercise of profession carried on by Mr. X.

b) Company XYZ manufactures and sells motor vehicles. It has recently launched an electric car. It provides free test drives to its potential customers. Will this benefit come under the purview of section 194R? The customers are end users of the motor vehicle and do not engage in any business or profession to avail of such benefit. Therefore, in this case, since the benefit of free test drives has been provided to end consumers, such a benefit would not fall under the purview of section 194R.

2) The next point worth noting here is that section 194R does not apply to the benefits/perquisites arising in an employer-employee relationship. The benefits or perquisites provided by an employer to his employee are covered under section 17 and the employer has to deduct tax on the same under section 192 of the Act.

3) The taxpayers must also note that for section 194R to be applicable, the person providing the benefit may be a resident or a non-resident, but the receiver must be a resident. The same has been tabulated hereunder:

| Benefit/Perquisite Provider |

Benefit/Perquisite Receiver |

Section 194R Applicability |

| Resident/Non-Resident |

Resident having business or profession. |

Section 194R will be applicable. |

| Resident/Non-Resident |

Resident being an end consumer. |

Section 194R will not be applicable. |

| Resident/Non-Resident |

Non-Resident |

Section 194R will not be applicable. |

Coming to the guidelines issued by CBDT in respect of section 194R, let us walk through the following question-answers to build an understanding of the same:

Question 1

Is the person providing benefit or perquisite required to check if the amount is taxable in the hands of the recipient before deducting tax under section 194R?

Answer 1. No, in order to deduct tax u/s 194R, the deductor is not required to check whether the amount of perquisite or benefit that he is providing would be taxable in the hands of the recipient or under which section it would be taxable.

Question 2

Is it compulsory that the benefit or perquisite must be in kind for section 194R of the Act to operate?

Answer 2. No, it is not necessary that the benefit or perquisite must be in kind for section 194R of the Act to be applicable. The benefit or perquisite might be in cash or kind or partly in cash and partly in kind.

Question 3

Is there any obligation to deduct tax under section 194R of the Act if the perquisite or benefit is in the form of a capital asset?

Answer 3. Yes, the deductor has to deduct tax u/s 194R of the Act in all cases where benefit/perquisite is provided regardless of the fact, whether it is in the form of capital nature or revenue nature.

Question 4

Is TDS applicable on cash discount, sales discount and rebates under section 194R?

Answer 4. As per the guidelines issued by CBDT, no tax is required to be deducted under section 194R on cash discount, sales discount and rebates allowed to customers.

However, the guidelines further clarify that this relaxation should not be extended to other benefits the seller provides in connection with the sale. The following are some examples of benefits/perquisites on which tax has to be deducted under section 194R of the Act:

- When a person provides incentives (other than discount, rebate) in the form of cash or kind such as computers, TV, car, gold coin, mobile phone etc.

- When a person provides free tickets for an event

- When a person sponsors a trip for the recipient and his/her relatives upon achieving certain targets

- When a person gives medicine samples free to medical practitioners

Question 5

How to compute the value of benefit/perquisite for TDS under section 194R?

Answer 5. The valuation of the benefit or perquisite would be based on its fair market value except in the following cases:

(1) The person providing the benefit or perquisite has purchased the same before providing it to the recipient. In this case, the purchase price shall be taken as the value of such benefit or prerequisite.

(2) The person providing the benefit/perquisite manufactures such items given as such benefit or perquisite. In this case, the price the benefit/perquisite provider charges its customers for such items shall be the value for such benefit/perquisite.The circular further clarifies that GST will not be included for the purposes of valuation of perquisites for TDS under section 194R.

Question 6

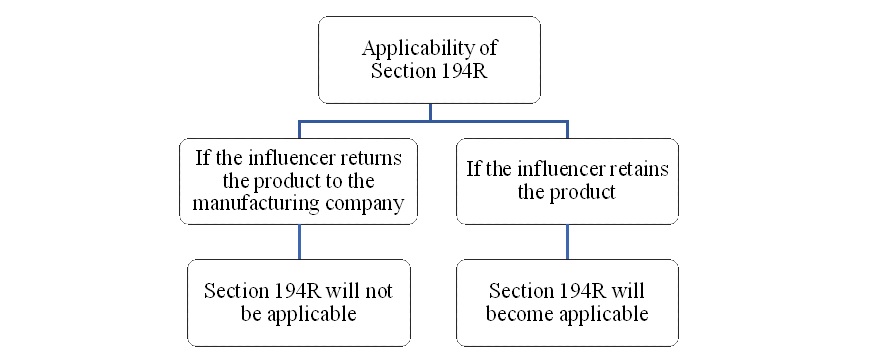

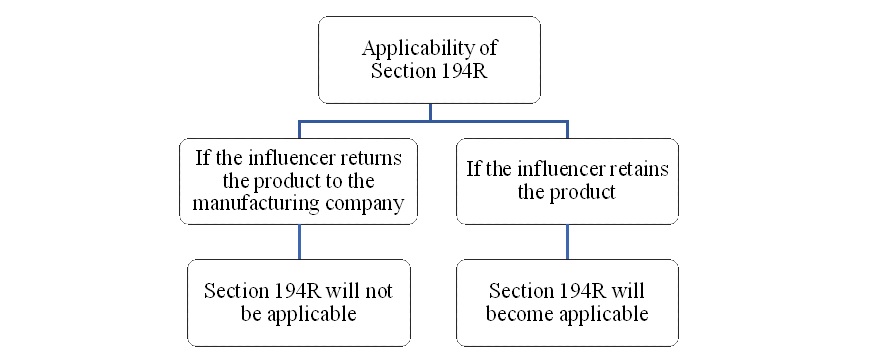

Often, a social media influencer is given a product of a manufacturing company so that he can use that product to make audio/video speaking about that product on social media. Is this product given to such an influencer a benefit or perquisite?

Answer 6. Whether this will constitute a benefit or perquisite under section 194R will depend upon whether the product is retained by the influencer or not. It can be understood as follows:

Question 7

Question 7

Whether reimbursement of the out-of-pocket expenses incurred by a service provider in the course of rendering service is benefit/perquisite?

Answer 7. Whether reimbursement of the out-of-pocket expenses incurred by a service provider for rendering services would constitute a benefit/perquisite for section 194R would again depend on the following two situations:

Question 8

Question 8

Should expenditure on business conferences held to educate the dealers about the company’s products be considered a benefit or perquisite for section 194R?

Answer 8. The expenditure incurred on a dealer or business conference would not be considered as a benefit for section 194R of the Act if such conference is held with the prime objective to educate dealers or customers about any of the following or related aspects:

- new products being launched

- discussion as to how the new product is better than others

- teaching sales techniques to dealers/customers

- obtaining orders from dealers or customers

- addressing the queries of the dealers/customers

- reconciliation of accounts with dealers or customers

However, such a conference should not be in the nature of benefits/incentives to select dealers/customers who have achieved specific targets.

The circular further provides certain cases where the expenditure incurred for the conference would be considered a benefit for the purposes of section 194R. These cases are as follows:

- Expenses pertaining to leisure trip or leisure component, even if it is incidental to the conference.

- Expenses incurred for family members accompanying the person attending the conference.

- Expenses incurred for the stay of participants of the conference for days prior to or beyond the dates of such conference.

Question 9

Section 194R requires that if the benefit/perquisite is in kind or partly in kind and cash is not sufficient to fulfil the TDS liability, then the person responsible for providing such benefit or perquisite has to ensure that the tax required to be deducted has been paid on such perquisite, before releasing the same to the recipient. How can such a person be satisfied that the tax has been deposited?

Answer 9. The law requires that if a person is providing benefit/perquisite in kind to a recipient and tax is to be deducted under section 194R of the Act; the person is required to ensure that the tax to be deducted has been paid by the recipient. The recipient would pay such tax in the form of advance tax. The benefit provider may rely on a declaration and a copy of the advance tax payment challan given by the recipient confirming that the tax required to be deducted on the benefit or perquisite has been deposited. It would then be required to be reported in the TDS return along with the challan number. This year, Form 26Q has been amended to include provisions for reporting such transactions.

As an alternative option to remove the difficulty, if any, the benefit provider may deduct the tax u/s 194R of the Act and pay it to the Government. The benefit provider should deduct tax after considering the fact that the tax paid by him as TDS is also a benefit u/s 194R. In Form 26Q, he will have to show it as tax deducted on the benefit provided.

Question 10

Section 194R is applicable from when? How to compute the limit of twenty thousand for Financial Year 2022-23?

Answer 10. Section 194R has become effective from 1

stJuly, 2022.

In the circular issued by CBDT, it has explained that since the limit of twenty thousand rupees is for the financial year, the value of all the benefits provided from 1

st April, 2022 to 31

st March, 2023 would be considered for calculating the aggregate value of the benefits or perquisites to check the applicability of section 194R for FY 2022-23. However, the benefit or perquisite provided on or before 30

th June, 2022 would not be subjected to TDS u/s 194R of the Act.

For example: Suppose you provide perquisites to a resident twice in

FY 2022-23: once on

17thMay, 2022,of an amount of

Rs. 10,000 and next on

6th November, 2022,

amounting to Rs. 15,000. In this case, to determine the applicability of section 194R based on the threshold limit,

Rs. 10,000 will be added to

Rs. 15,000 and the total amount of

Rs. 25,000 will be considered for

FY 2022-23.

However, you will be liable to deduct tax on the perquisite provided only on

6th November, 2022, i.e., Rs. 15,000 and not on the entire amount of

Rs. 25,000 as the sum of

Rs. 10,000 pertains to the first transaction that took place before

1stJuly, 2022.

To Conclude:

It can be seen that section 194R aims to bring varied transactions carried out to provide different benefits to various stakeholders under the purview of tax from its very source of origin. Hence, from now onwards, the taxpayers need to recognise transactions in the nature of benefits and perquisites and get themselves well acquainted with the new

TDS provisions.

Unlock growth and ensure compliance with Section 194R. Learn more about tax deductions on benefits and perquisites for your business or profession. Contact us today at

info@manishanilgupta.com

Disclaimer: This content is purely for knowledge and educational purposes. It contains only general information and references to legal content. It is not legal advice, and should not be treated as such

0 Comment