.jpg)

The Ultimate Guide to Transfer Pricing Methods for Business Success

Unlock the secrets of transfer pricing and navigate global taxation with confidence. . . .Jun 27, 2023

Read More

Contact us

E-Invoicing has been made applicable from 01st October 2020 to all the businesses having aggregate turnover more than Rs.500 crores in any of the preceding financial years from 2017-18 to 2019-20. Further, from 01st January 2021, E-Invoicing will apply to businesses exceeding Rs.100 crores turnover in any FYs between 2017-18 to 2019-20, as specified via Notification No. 88/2020 –Central Tax.

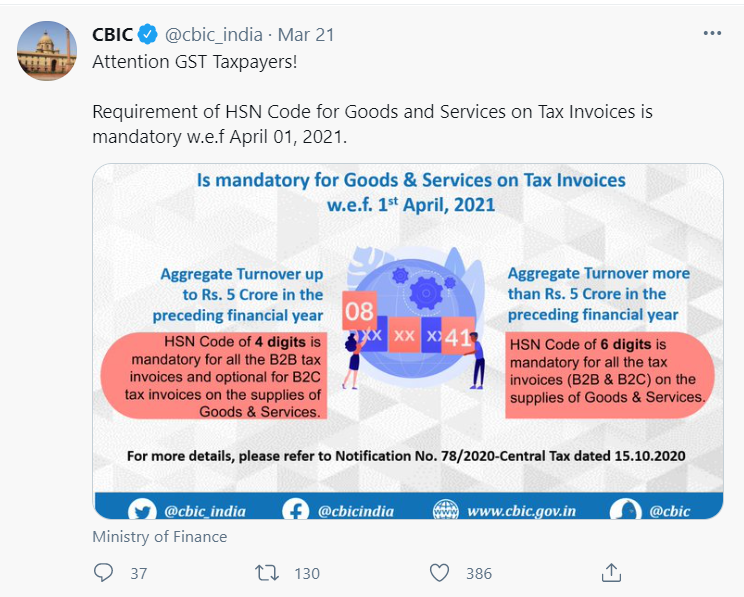

The CBIC vide its tweet dated 21st March 2021 has provided that HSN Code of 4 digits is mandatory for B2B tax invoices on supplies of goods and services for taxpayers having aggregate turnover up to Rs. 5 crores in the preceding FY.

As for taxpayers having an aggregate turnover of more than Rs. 5 crores in the preceding FY, it has been provided that an HSN Code of 6 digits is mandatory for all tax invoices viz. B2B and B2C, on supply of goods and services.

It is crucial to mention the correct HSN/ SAC Code on the tax invoices and GSTR-1; otherwise, a penalty of Rs. 50,000/- (Rs. 25,000/- each for CGST & SGST) can be levied for non-mentioning or mentioning the wrong HSN/ SAC Code under Section 125 of the Central Goods and Services Tax Act, 2017.

Blogs

In today’s business environment, the world demands quality professional services that are provided in a timely and cost-effective manner. We, at Manish Anil Gupta & Co, believe in putting our client’s needs squarely in front at all times.

"Need to know more about our services or what we do? Drop us your contact details and one of our professionals will call you to answer your query!"

0 Comment