Introduction

Whether your business needs tax registration help, return filing services or a custom-built GST compliance powerhouse that suits your company, Professional Services places the best expertise in your controls. Our team consists of GST domain experts, chartered accountants and lawyers who are dedicated to serving you in every sphere from tax analysis to specific projects and

GST Compliance solutions in India. Collectively, our team is here to lead you through the tangle of GST arrangements and support you getting excellent results in framing any transaction.

What is GST Compliance?

We at

MAG provide best

GST compliance services in Delhi. The GST Council has laid down rules and regulations for regular compliances by a GST registered person. These generally cover the following areas for compliance needs:

- Maintaining Books of accounts and keeping of other relevant documents

- Issue of invoices

- Reporting of Sales and Purchases

- Payment of Tax Liability

- Filing of GST returns

Technically, adherence to rules and regulations in the above areas is what constitutes the compliance under GST. Being non-compliant, for a business can cost heavily. However, some entities are yet to adopt the right process to become GST compliant. If you are looking for a

GST compliance service provider in Delhi, MAG is a best option for your business. You can reach us at

info@manishanilgupta.com

Let us discuss some essential compliance areas where a GST registered person should focus on dressing his organisation GST ready.

1. Find out whether you are liable to register under GST compulsorily

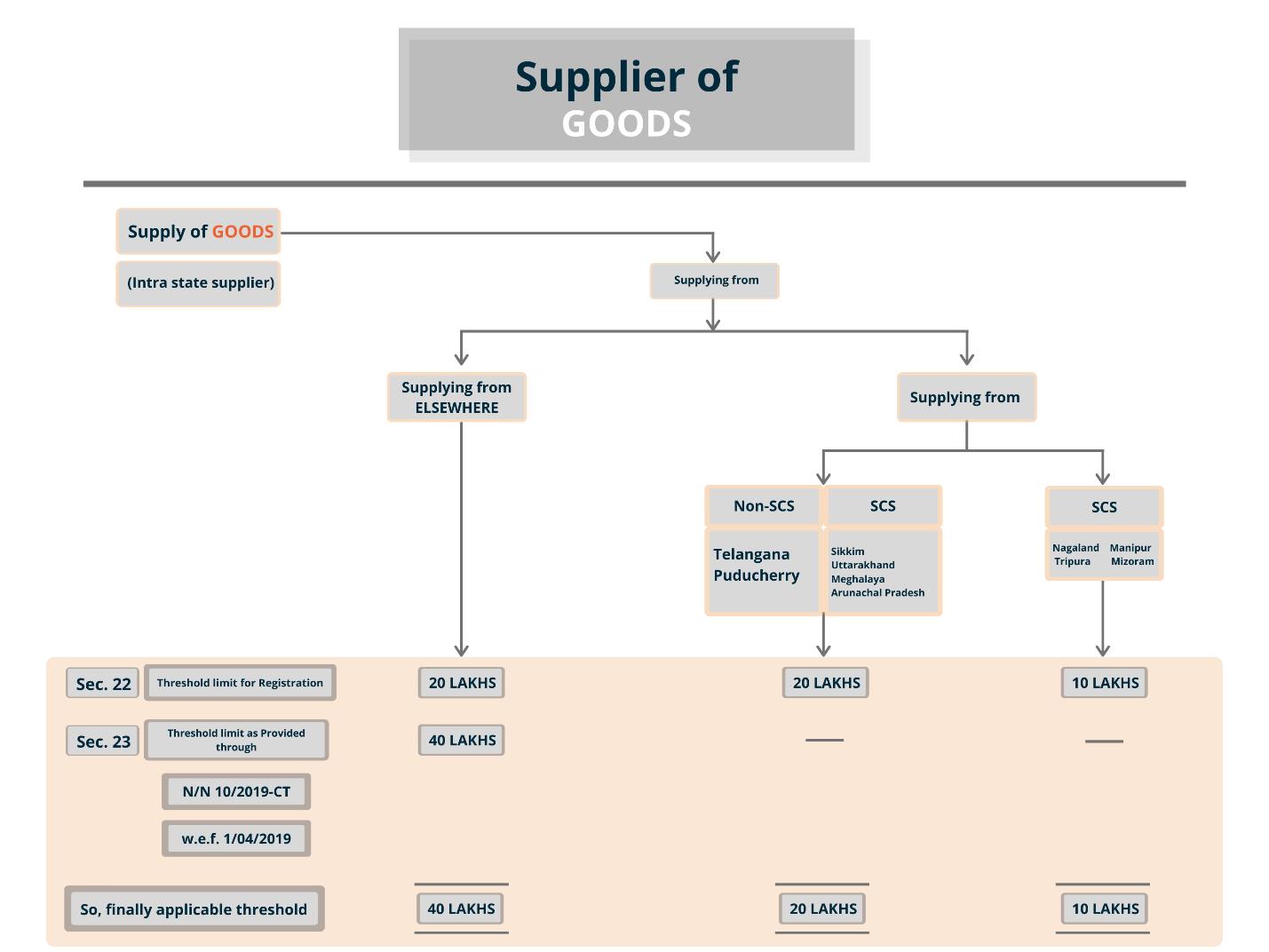

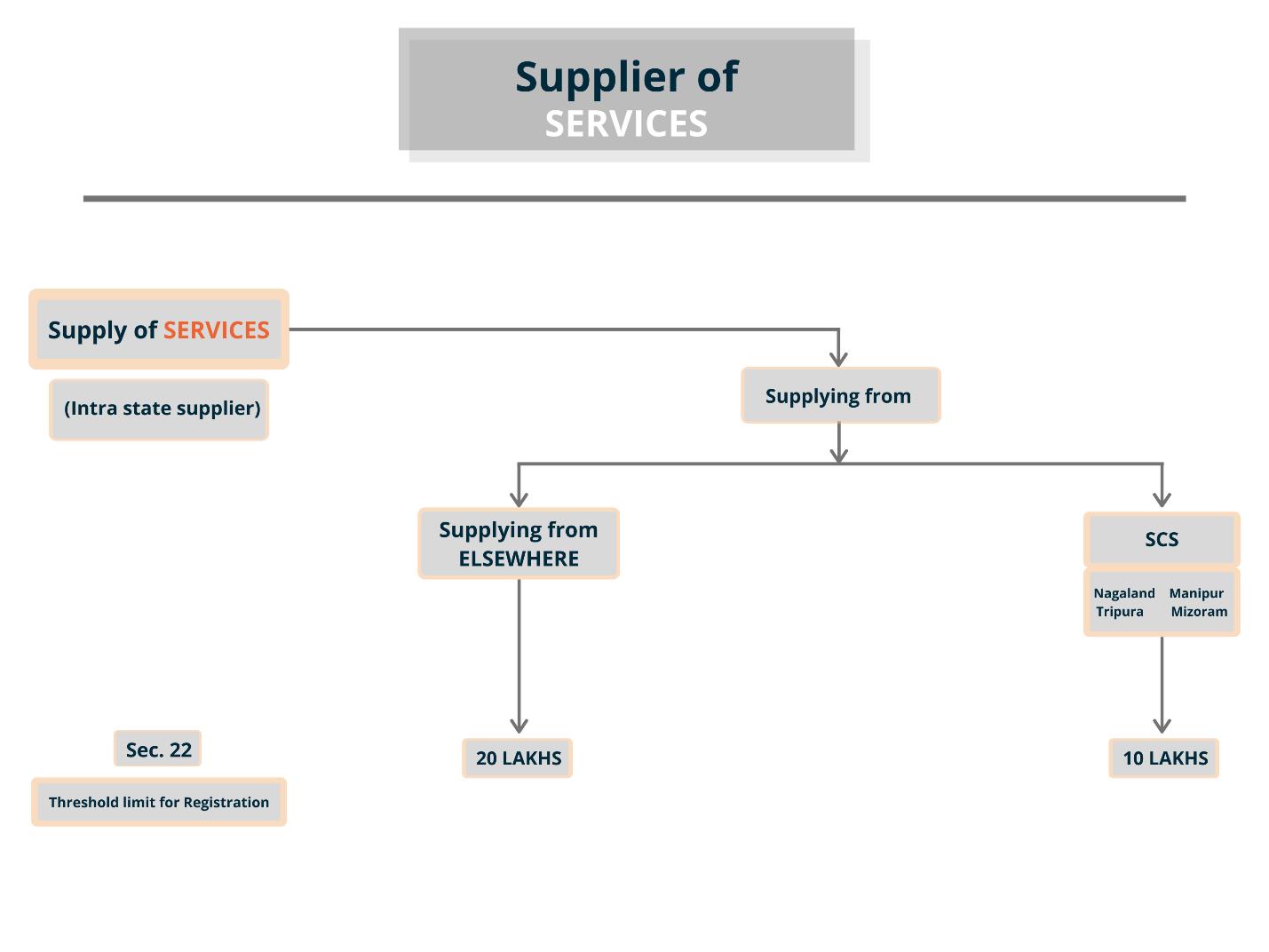

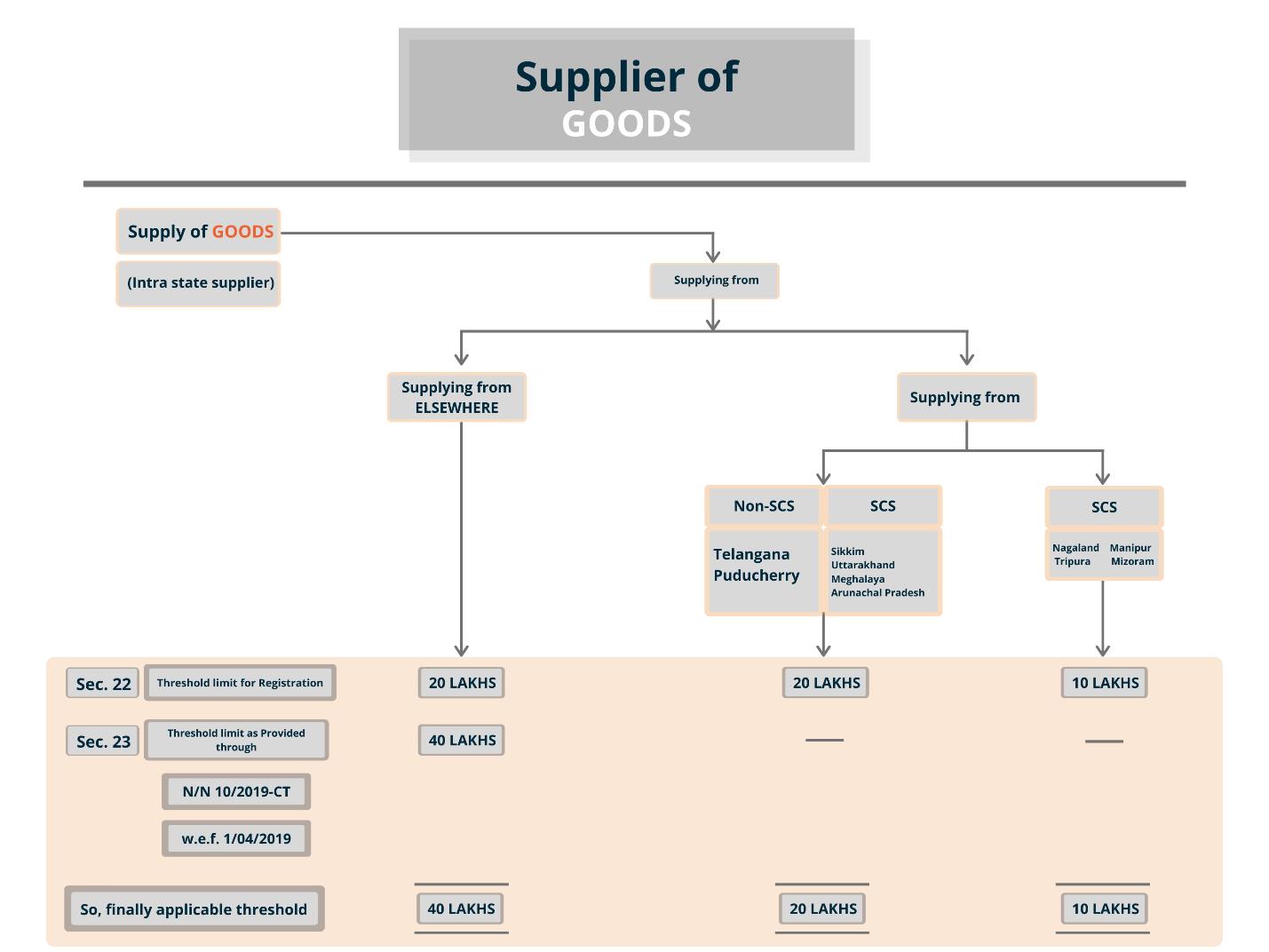

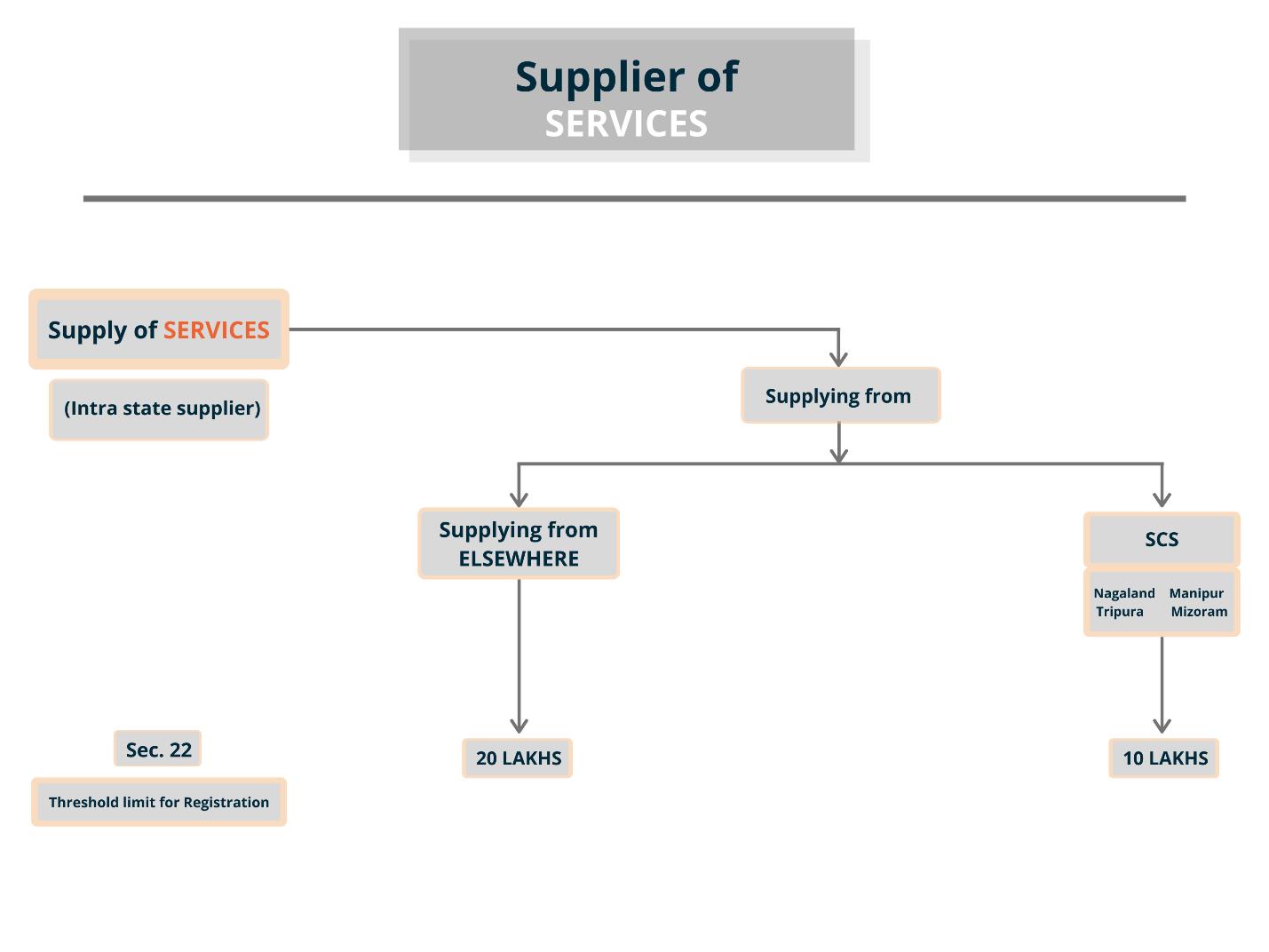

As per section 22 of CGST/SGST Act 2017, every supplier who makes a taxable supply which is leviable to tax in GST, and whose aggregate turnover (ATO) in a financial year exceeds the threshold limit of Rs 20 lakh shall be liable to register himself in the state or UT from where he makes the taxable supply.

In the case of

4 special category states (SCS) namely,

Nagaland, Manipur, Tripura, Mizoram the threshold limit is Rs 10 lakh.

However, in terms of

Sec 23(2) of CGST Act read with N/N 10/2019, w.e.f. 1st April 2019, a supplier of goods (exclusive supplier of goods) can consider taking registration only when his ATO in the FY

crosses 40 lakh. This relaxation is not applicable if:

(a) persons required to take registration under section 24 compulsorily

(b) persons engaged in making supplies of following goods

(i) Ice Cream and other edible ice;

(ii) Pan Masala;

(iii) Tobacco and manufactured tobacco substitutes;

(c) persons engaged in making intra-state supplies in special category states of

Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland, Puducherry, Sikkim, Telangana, Tripura, Uttrakhand; and

(d) persons opting for voluntary registration or already registered persons who want to continue with its registration

The following categories of persons are required compulsorily irrespective of the threshold limit:

i) persons making inter-state taxable supplies

exceptions

1. inter-state supply of certain handicraft or craftsman's goods if ATO is up to 20 lakh ( 10 lakh in 4 SCS)

2. inter-state supply of services if ATO is up to 20 lakh ( 10 lakh in 4 SCS)

ii) Casual taxable persons making taxable supply;

iii) non-resident taxable person (NRTP) making taxable supply

iv) persons required to pay tax under the reverse charge mechanism

v) persons required to pay tax under section 9(5) (i.e. ECO liable to pay GST in case of 3 notified services)

vi) persons who supply goods/services, other than supplies specified under section 9(5), through such e-commerce operator (ECO) who are required to collect tax at source under section 52 (i.e. ECO receiving payment from buyers and handling over to connected supplier; in between, ECO is liable to pay TCS @ 1%).

exception

Supplier of services supplying through ECO if his ATO is up to Rs 20 lakh (10 lakh in 4 SCS)

vii) persons required to deduct TDS under section 51

viii) every ECO who is required to collect tax u/s 52

ix) persons who make taxable supply of goods or services on behalf of other taxable persons whether as an agent or otherwise

x) Input service distributor (ISD)

xi) every person supplying online information and database access or retrieval services from a place outside India to a person in India, other than a registered person (i.e. overseas supplier of OIDAR services to unregistered Indian person)

xii) Notified persons or class of persons

Let us have a look for a quick understanding of the registration threshold!

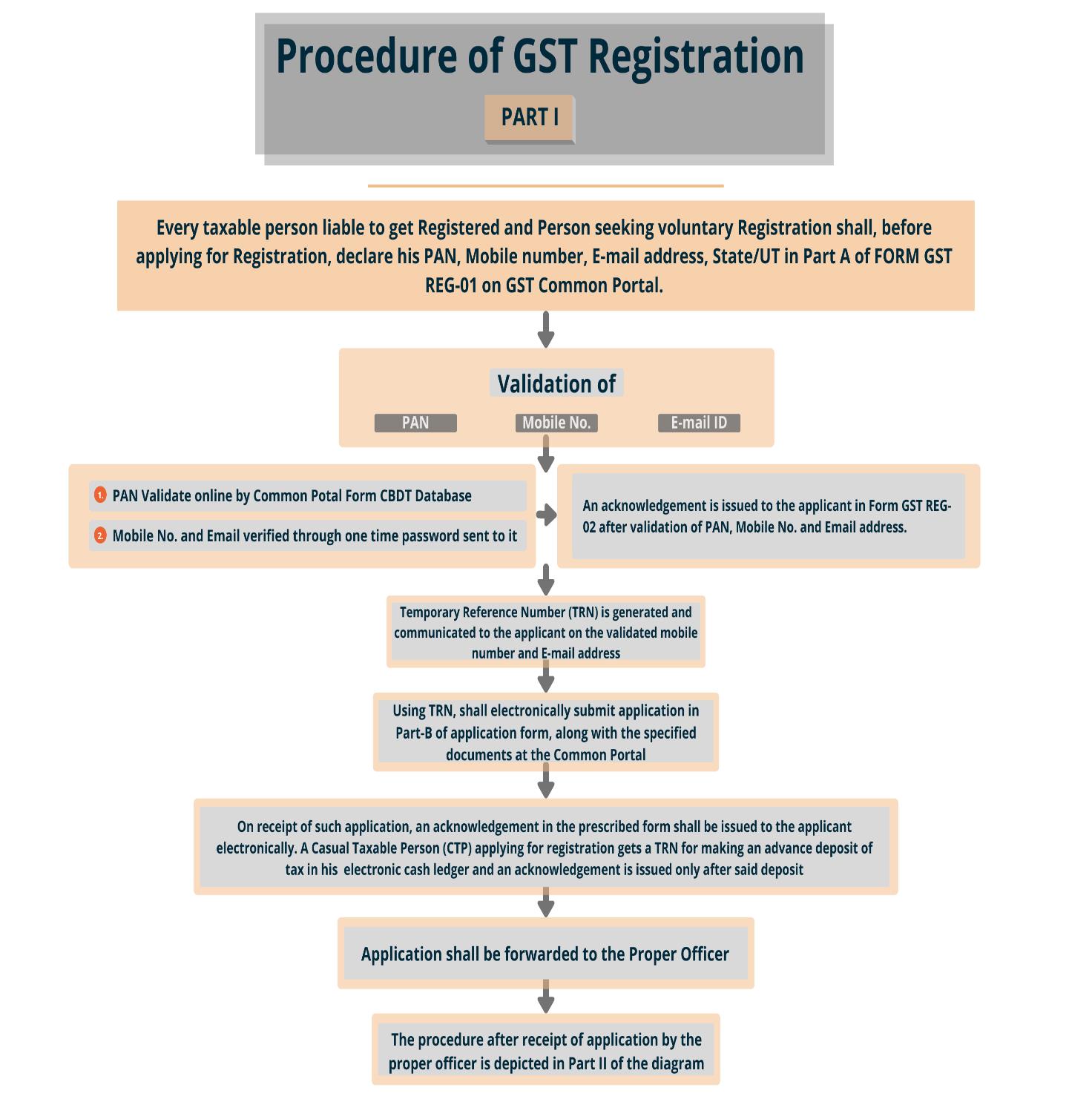

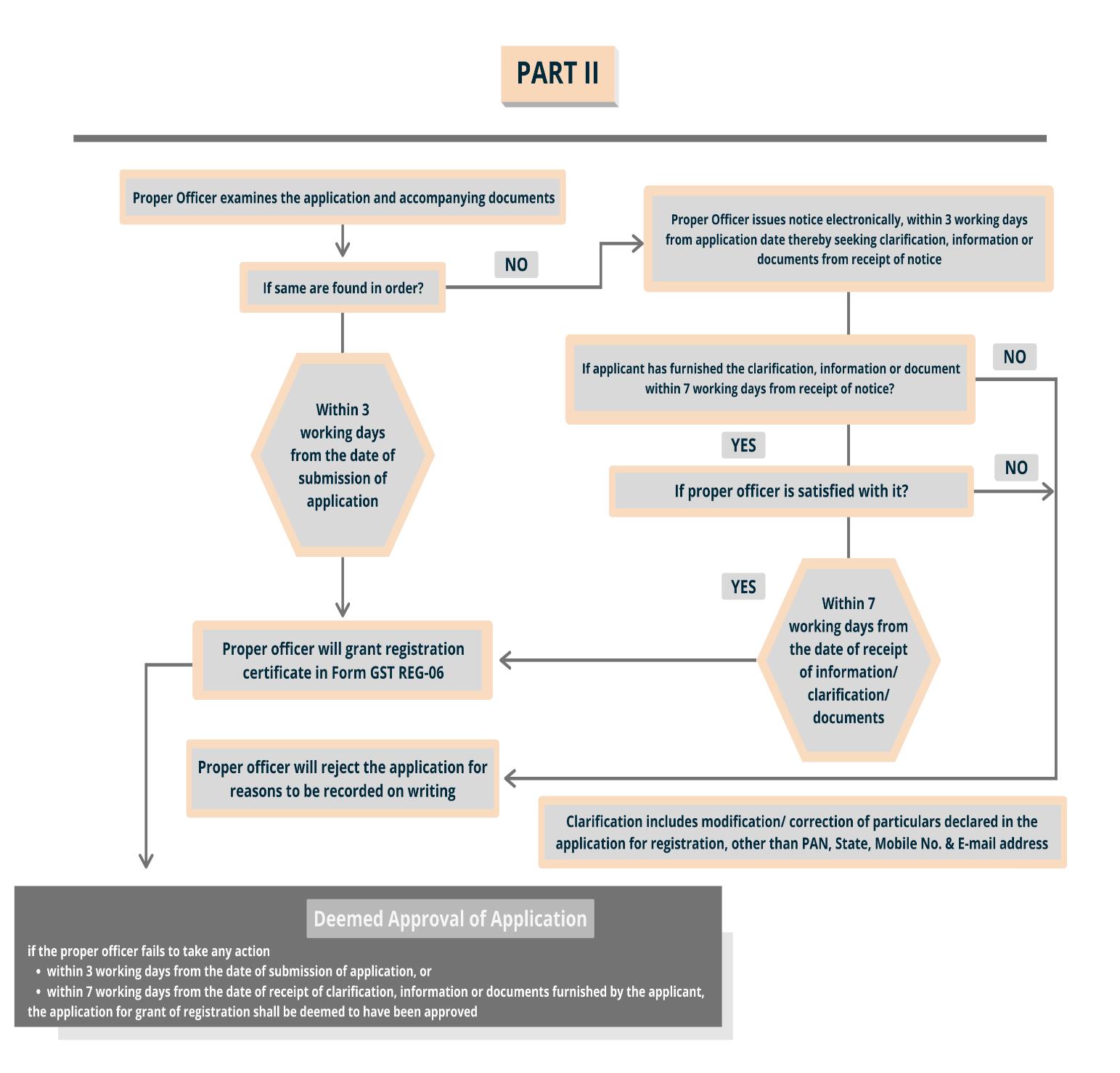

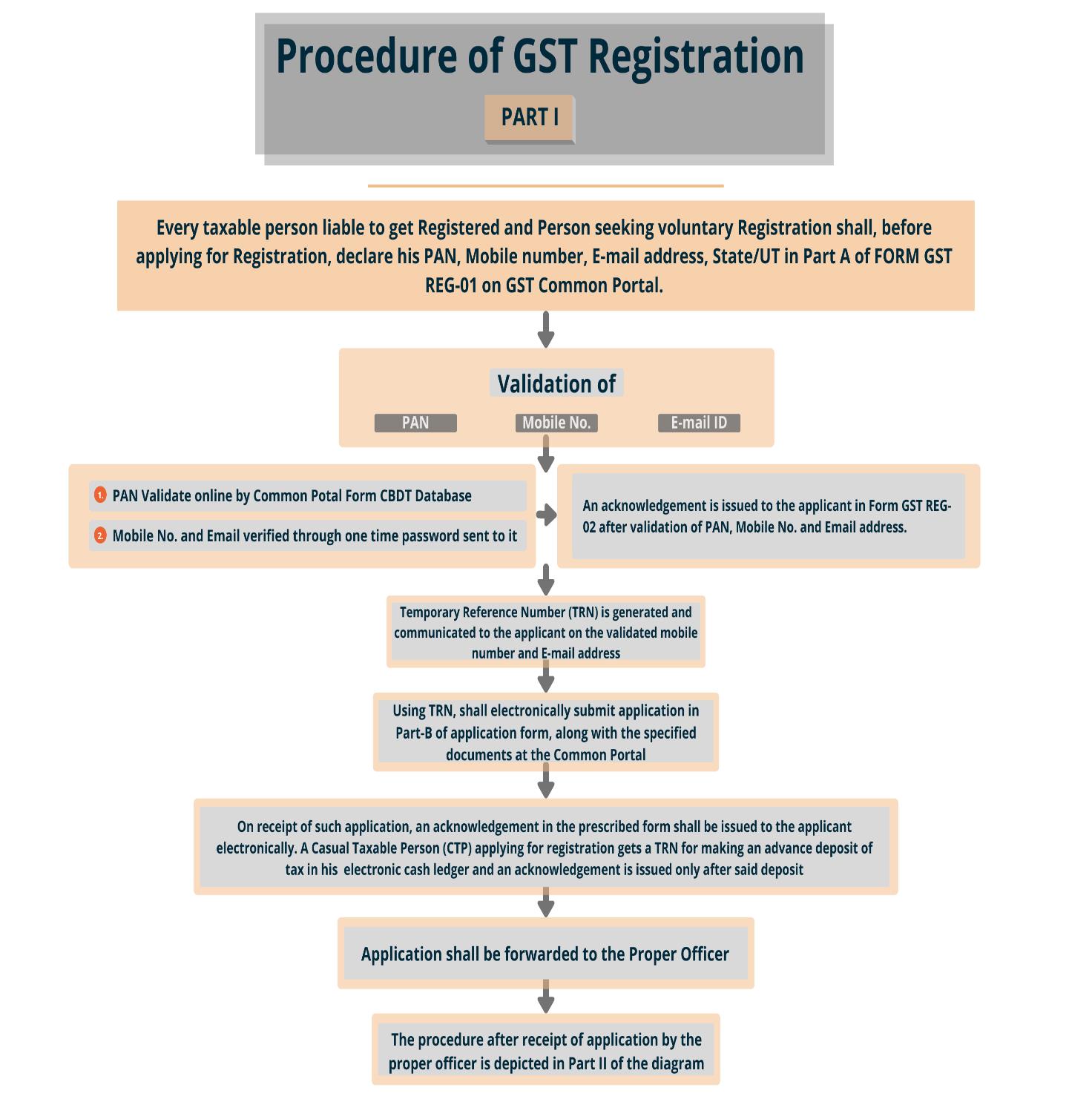

2. Obtain GST Registration

2. Obtain GST Registration

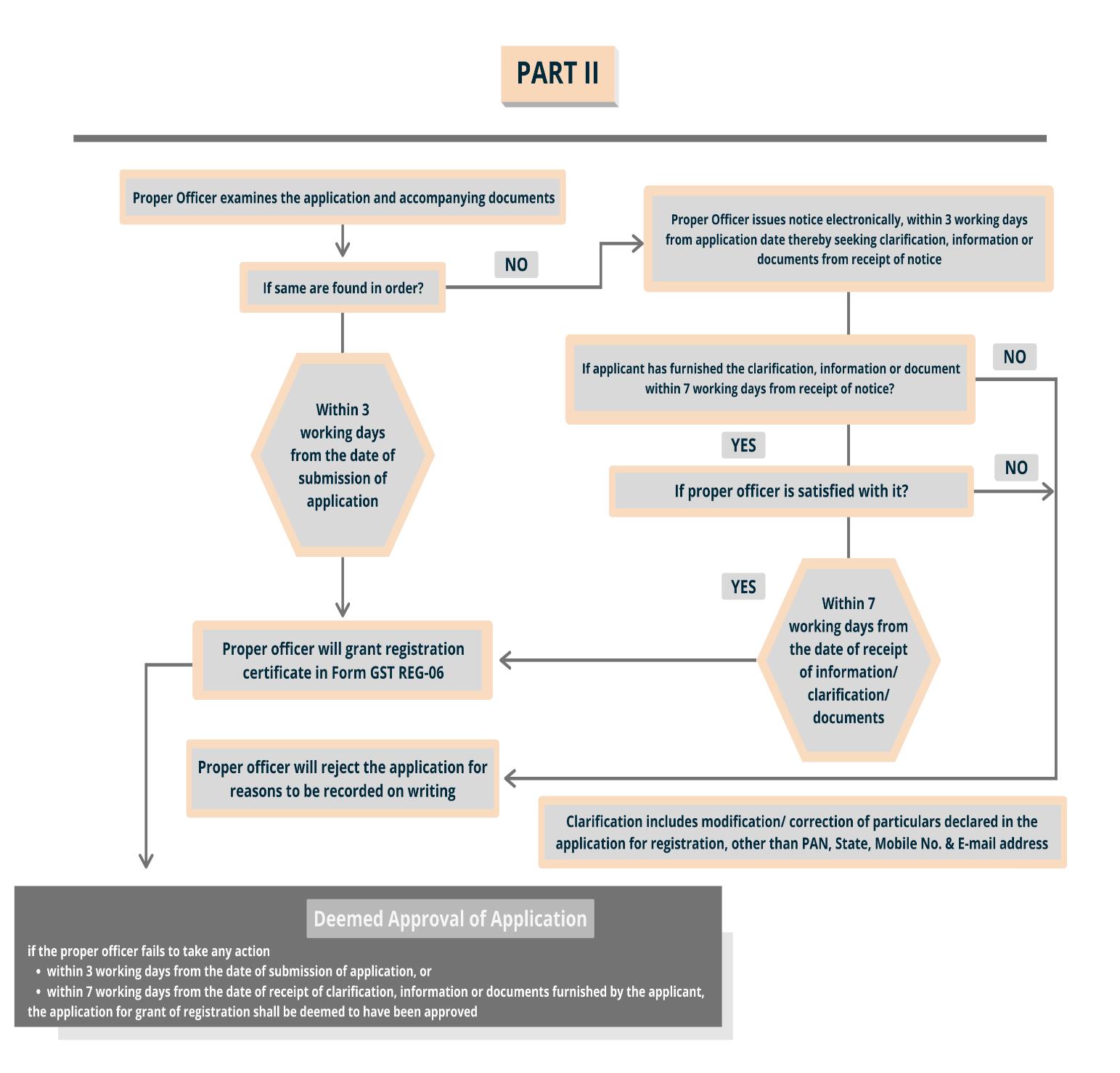

Once a supplier is clear about whether he is liable to get registered or not under GST, the next step is to obtain registration if he is required to get under the provisions explained above. Getting registration is online and a straightforward process. Let us understand the process of

GST registration through a flow chart.

Process of GST registration

3. Issue and receipt of proper invoices under GST

An invoice is a vital document evidencing the supply of goods and services and the

value of supply under GST. It is an essential determinant of time of supply, i.e. when the liability to pay GST arises. It is also a mandatory document to avail Input Tax Credit.

4. Identify correct HSN/SAC Codes & Tax Rates

In invoicing, it is essential to determine the correct HSN/SAC and applicable tax rates. With tax rates, it is equally crucial for a registered person to be aware of correct HSN/SAC codes primarily for the following reasons:

One, it will have an impact on GST invoicing – if your turnover is above 1.5 crores, but below 5 crores, the registered needs to use 2-digit code, and if the turnover is 5 crores and above, 4-digit code is required. If the turnover is below 1.5 crores, such codes are not required at all.

Two, there should be consistency as far as the names of the goods and or services are concerned. The different persons use different names, and the government has specified a standard name for all goods/services to avoid ambiguity. For seamless business operations and related compliances, it becomes very crucial to implement these codes.

5. Ensure correct GSTIN while dealing with Vendors and Customers

Probably one of the most critical steps for your business in the GST era is to ensure that you can take a right and appropriate input tax credit. Similarly, a customer takes input tax credit on a supply made by you. For that, you need to ensure that you have provided your GSTIN correctly to your vendor so that the same is adequately recorded in the tax invoice of your purchase.

Similarly, ensure that you are capturing the GSTIN of your customer on the sales' tax invoice' so that your customer can claim ITC. It will help you in conducting your business seamlessly and will allow you to manage your vendors and customers effectively.

6. Filing of GST returns on time

Filing GST returns online in India on time is an essential aspect of GST compliance. Returns need to be filed even if a registered person has not been involved in business activity for a specific return period. All returns must be filed electronically on the common portal of GST. Once filed, the details cannot be revised, but changes and modifications can only be done in subsequent filings. Accomplishing this responsibility without the guidance of a professional is going to be hard. For filing the returns correctly one needs professional help and we at MAG assist our clients in

GST return filing online through the portal.

Choose the right professional!

As there are various returns, a registered person is required to file and so the compliances under GST, it is pertinent to hire a correct professional who can manage your GST compliances effectively. It is very challenging to comply with all this at own without committing the errors. Hence, We at

MAG provide the best quality

GST services in Delhi and across India to our clients which helps them in meeting these regular compliances without investing their precious time. We are the best GST filing consultants in India.

So, if you are seeking GST Compliance services in Delhi, kindly get in touch with us at

info@manishanilgupta.com and experience the finest services in the field of GST from our team of experienced professionals.