The Ultimate Guide to Transfer Pricing Methods for Business Success

Unlock the secrets of transfer pricing and navigate global taxation with confidence. . . .Jun 27, 2023

Read More

Contact us

This year, taxpayers are very much confused while making their investment declarations to employers for tax deduction at source (TDS). This confusion is nothing but the selection of old regular income tax regime or the newly introduced regime in this year’s budget. Now it is becoming a headache for taxpayers whether to stick with the old regime by availing tax deductions or forego certain deductions and claim lower tax rates under new optional income tax regime.

Let us try to understand some differences between the two schemes.

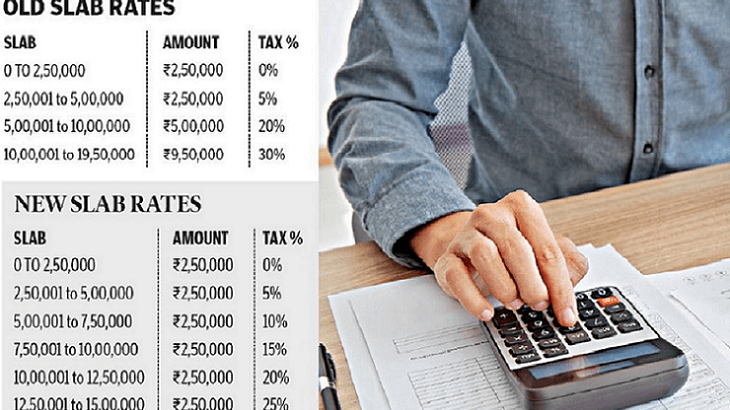

The regular old tax regime provides 3-tier tax rate slabs:

5% – Income above Rs 2.5 lakh up to Rs 5 lakh

20% – Above Rs 5 lakh up to Rs 10 lakh

30% – Income over Rs 10 lakh

While computing taxable income under the old scheme, individuals can claim tax-free allowances like Leave Travel Concession (LTC), House Rent Allowance (HRA), and other specific allowances. Additionally, standard deduction of Rs 50,000, the deduction for home loan interest, Chapter VI-A deductions(including Life Insurance and Health Insurance deductions) for tax saving investments, etc., allow taxpayers to reduce their taxable income and thereby to lower income tax outgo by investing in different schemes.

The new discretionary tax regime offers 6-tier tax rate slabs with lower tax rates if taxpayers are ready to forego a set of 70 exemptions and deductions. The new rates are:

5% – Income above Rs 2.5 lakh up to Rs 5 lakh

10% – Above Rs 5 lakh up to Rs 7.5 lakh

15% – Above Rs 7.5 Lakh up to Rs 10 lakh

20% – Above Rs 10 lakh up to Rs 12.5 lakh

25% – Above Rs 12.5 lakh up to Rs 15 lakh

30% – Income over Rs 15 lakh

Under the new regime, the taxpayers have to forego many exemptions and deductions including HRA, LTC, standard deductions, Chapter VI-A deductions like life insurance, investment in PPF, ELSS, home loan interest, tuition fees etc. available under the existing old regime of income tax laws.

The important point which taxpayers should keep in mind that income up to Rs 5 lakh is exempt under both the regimes.

Prima facie, it appears from the new regime that lower tax rates will result in lowering taxpayer’s income tax outgo. However, the benefit of reduced rates proves to be inconsequential and sometimes not decisive, since the removal of exemptions and deductions counterpoises the same. Those who have made investments to claim tax reliefs will not find this regime attractive at all.

Taxpayers with no housing loan, staying in rent-free accommodation and preferring to make little or no investments may find the new scheme useful. The decreased rates will also give more disposable income in the hands of people who do not want to lock their money in prescribed investments for any reason.

Based on a comprehensive calculation, the old scheme is more beneficial to those taxpayers who claim exemptions/deductions of more than Rs 2.5 lakh. However, taxpayers should perform a comparative analysis of their tax liabilities under the old and new regime. If the taxpayers were availing a significant amount of tax breaks, then it would be better to continue paying tax under the old scheme.

Individuals not having business income shall be provided with an opportunity to choose between the old scheme or new scheme every year, and thus, may exercise the more advantageous alternative after thorough evaluation each year. However, for individuals having a business income, option once adopted shall be final. Salaried individuals are allowed to choose between old and new scheme at the time of making their investment declaration to the employer for TDS deduction. Even if an individual selects one option at the time of submitting a declaration to the employer for deduction of TDS, he is free to change the option and opt the more beneficial one, at the time of filing the Income-tax return.

"Confused about which income tax regime to choose? Understand the differences between the old and new regimes and make an informed decision. Maximize your tax savings and optimize your financial strategy. Choose the right tax regime for you today!" Feel free to contact us at info@manishanilgupta.com

Disclaimer: The information given above is to provide general guidance to the readers. This information should not be sought as a substitute for legal opinion

Blogs

In today’s business environment, the world demands quality professional services that are provided in a timely and cost-effective manner. We, at Manish Anil Gupta & Co, believe in putting our client’s needs squarely in front at all times.

"Need to know more about our services or what we do? Drop us your contact details and one of our professionals will call you to answer your query!"

0 Comment