- By Admin

- Category Company and LLP Compliances

- Views 1015

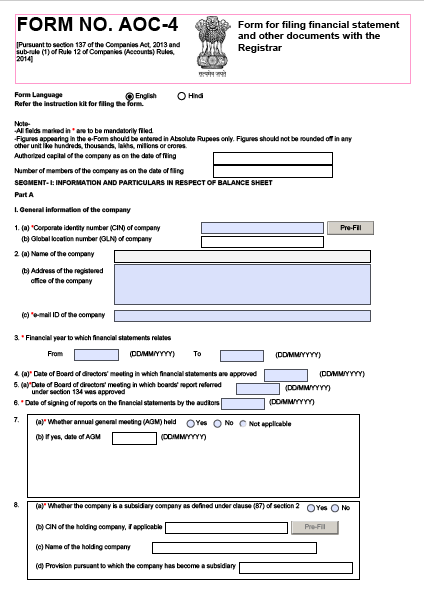

Running of Private Limited or Public Limited Company was utilized to be a simple procedure under Companies Act, 1956 as enlistment registrar of company (ROC) didn’t use to make any severe move against defaulter yet, But Under New Companies Act, 2013there are stringent reformatory arrangements for resistance and if there is any occurrence of default; organization, administrative faculty, are obligated to substantial punishment in money related terms and other non-fiscal correctional results too. Subsequently, it is important that the compliances met with on time to time compliances so as to stay away from punishments or extra expenses or burden. To maintain a strategic distance from these dangers, we can help you by giving services to administrations to ensure that you fulfill all requirements as per the ROC compliance schedule or some other sort of compliances in an organization.

- By Admin

- Category Goods and Service Tax

- Views 435

Our country is going through one of its biggest tax reforms ever. While the whole world is watching the roll out without battling an eye, India is on the way towards a destination based tax reporting system.

Now, every transaction must be reported along with invoice which identifies the seller and recipient of good and services.

In order to record such invoices, the process has been simplified by removing a myriad of taxes. The entire nation, now reports through same structure.

- By Admin

- Category Income Tax

- Views 428

Worried about ITR? Then this write-up is for you! Before hiring a tax consultant you must be aware of important ITR facts. Read on to know more about ITR filing.

The deadline to file an ITR is approaching. If you have never filed an ITR before, you may find the task to be a daunting one.

You can reduce all the stress by getting a tax consultant on board. It is also important that you are aware of certain facts about filing ITR. Here are some important things that you must keep in mind, especially if you are filing an ITR for the first time:

- By Admin

- Category Miscellaneous

- Views 2134

- By Admin

- Category Miscellaneous

- Views 1621